Cerro de Pasco Resources Announces Positive Preliminary Economics Assessment for the Santander Mine

February 21, 2023

MONTRÉAL, CANADA – (February 21, 2023) Cerro de Pasco Resources Inc. (CSE: CDPR) (OTCMKTS: GPPRF) (Frankfurt: N8HP) (“CDPR” or the “Company”) is pleased to announce the results of the Preliminary Economic Assessment (“PEA”) for its brownfield Pipe Project (“the Project” or “the Santander Pipe”). The Project forms a strategic cornerstone for CDPR’s 100% owned Santander Mine, located in central Peru. A NI 43-101 technical report will be filed on SEDAR and will be available on the Company's website within 45 days. All dollar amounts are in US dollars, unless otherwise noted.

- The Santander Pipe demonstrates positive financial returns, with a pre-tax net present value (“NPV”) at 6% discount rate of USD 71.3 million, generating an estimated internal rate of return (“IRR”) of 46.6%.

- The PEA considers the Project as a standalone operation with zinc concentrate production estimated at 313,600 dry metric tonnes (“dmt”) over a 5-year schedule.

- Project cash cost (“C1”) and all-in sustaining cost (“AISC”) of USD 0.82/lb Zn and USD 1.05/lb Zn, respectively, generating revenues of USD 388.6 million and pre-tax free cash flow of USD 99.6 million.

- Considered in the Project are synergies to be realized from the existing 2,500 tpd sulfide concentrator, electrical power grid, pumping station, water treatment plant, tailings facility, and other infrastructure from the existing Santander Magistral operation. Current on-going Magistral operation—mining and ore processing—is not considered in the PEA study.

- The mineral resource estimate (“MRE”) to be mined considers Indicated Mineral Resource of 3.23 Mt with 6.94% Zn and Inferred Mineral Resource of 1.78 Mt with 5.95% Zn; while the industrial circuit plans to process an average of 770,000t of mineralized material per year (with peak production at 900,000 tonnes year), with an average grade of 4.7% of Zn, 89% recovery and 51% in Zn concentrate grade.

- The Project is also set to benefit from significant potential resources, such as the Santander Pipe mineralization above the 4020 level, estimated to contain some 3 to 4 million tonnes averaging 4 to 6% Zn, and the newly discovered Pipe North zone.

“We are very pleased with the results of the PEA Study. The Santander Pipe is a compelling Project with robust economics for at least 5-years with low cost. The PEA validates our consolidated expansion and operating plan for the Santander operation.” said Jorge Lozano, CDPR’s Chief Operating Officer. “It outlines an updated life-of-mine plan, significant near-term upside potential, and steps taken to further de-risk the Project and secure financial performance.”

“Considering the economics of the study focuses only on the main area of the Santander Pipe, other technical adjustments and the new exploration discoveries, the PEA exceeds previous projections and confirms the transformative nature of the Santander Pipe Project for the Santander Mine. The CAPEX for the Pipe project will be in part funded through proceeds from the ongoing operation, thus allowing flexibility as we evaluate the best financing options for the project. The CDPR team continues to work diligently to maintain a strong focus on capital discipline, optimization of operating costs, design improvements, and equipment performance”.

| Unit | TOTAL | |

| Throughput Rate (tonne-per-day processed) | tpd | 2,500 |

| Estimated Production Period | years | 5 |

| Tonnes Processed | Million tonnes | 3.85 |

| Head Grade Zn | % | 4.67 |

| Metallurgical Recovery Zn | % | 89.0 |

| Head Grade Cu | % | 0.11 |

| Metallurgical Recovery Cu | % | 70 |

| Zn Concentrate Production | Thousand tonnes | 313.6 |

| Cu Concentrate Production | Thousand tonnes | 13.8 |

| Revenues (less by product cost)(1) | MUSD | 388.6 |

| Total OPEX | MUSD | 182.14 |

| Initial + Sustaining CAPEX | MUSD | 67.96 |

| EBITDA | MUSD | 167.6 |

| Pre-Tax Free Cash Flow (FCF) | MUSD | 99.6 |

| Operating Cost ($/t processed) | $/t | 47.35 |

| Total Cash Cost C1(2) ($/lb Zn) | $/lb | 0.82 |

| All-In Sustaining Cost(2) (“AISC”)1 ($/lb Zn) | $/lb | 1.05 |

| Pre -Tax - Net Present Value (6%) | MUSD | 71.3 |

| Pre-Tax Internal Rate of Return | % | 46.6 |

| After-Tax - Net Present Value (6%) | MUSD | 31.2 |

| After-Tax Internal Rate of Return | % | 25.1 |

| After-Tax Payback | years | 2.6 |

(1) Long-term metal price assumptions are: US$2,800/t of Zn, US$1,820/t of Pb, US$9,002/t of Cu, and US$22.0/oz of Ag

(2)Total cash cost C1 and AISC are non-GAAP measures; these parameters were estimated by CDPR in accordance with its cost structure, the remaining parameters in the table come directly from the PEA Financial Model prepared by DRA.

PEA SUMMARY

The Project is part of the Santander Property (“the Property”) and is close to the active Magistral Mine, which is a 2,500 tpd operation that has produced over 7.0 Mt @ 3 – 5% Zn, during 2013 – 2022. The Project used to be the old Santander Mine owned and operated by Compañía Minerales Santander (CMS) from 1957 to 1992, and according to historical records, produced over 8 million tonnes (Mt) @ 7% Zn with significant Pb-Ag content and minor copper credits. The PEA determines 2 years of pre-production development and a five-year production schedule, with annual production average of 62.7 thousand tonnes of zinc concentrate at average cash costs (“C1) and all-in sustaining costs (“AISC”) per tonne of zinc of US$0.82 and US$1.05, respectively.

- Santander Pipe Mineral Resource Estimate (MRE):

- Indicated Mineral Resources of 3.23 Mt @ 6.94% Zn and 0.17% Cu, with contained metal in the order of 224 thousand tonnes of Zn and 5.5 thousand tonnes of Cu.

- Inferred Mineral Resources of 1.78 Mt @ 5.95% Zn and 0.15% Cu, with contained metal in the order of 106 thousand tonnes of Zn and 2.7 thousand tonnes of Cu.

- The PEA describes additional geologic potential for the Project in two main components:

- The first upside potential is the Pipe North zone, an extension of the Santander Pipe mineral corridor, discovered in June 2022. DRA reviewed the exploration and validated the discovery of the Pipe North zone as a new exploration target. CDPR has budgeted more drilling for 2023 – 2024 to further explore and define the Santander Pipe North Extension, which is part of a 900 m long mineralization corridor that includes the Santander Pipe.

- The second upside potential comprises the unmined mineralization in the Upper Zone of the Santander Pipe, within the old mined out areas. The PEA MRE does not consider this area due to the old supporting information not being fully complemented and validated at the time of this report; the area should be further characterized once CDPR has access to the old Santander mine. Recent estimates indicate a potential resource of between 3 and 4 Mt in these upper levels.

- The mine access trade-off study supports the option to dewater and rehabilitate the old La Cuñada Shaft (“the Shaft”) for mineral hoisting, and the use of the ongoing Exploration Tunnel, from the Magistral Mine to the Santander Pipe, to execute the underground drilling program for resource definition and to mobilize personnel and equipment.

- The PEA supports the use of Avoca mining method with waste rock backfill and 20 and 15 m high sublevels in the Upper and Lower Zones, respectively. This is based on the geometry of the mineralized zones, geotechnical conditions, optimized stope recovery and dilution, and increased productivity up to 2,500 tpd production rate.

- The PEA metallurgical testwork indicates the possibility of upgrading the existing Santander Processing Plant to accommodate the additional capacity requirements to process both the Santander Pipe and Magistral Mine material. The upgrade of the Santander concentrator would involve the retrofit of additional equipment to the existing Pb circuit which will allow this circuit to also produce copper concentrate.

- The PEA metallurgical testwork show that the quality of concentrate is similar to the one achieved historically in the old Santander Mine. It is possible to obtain saleable commercial grade concentrates with no significant presence of deleterious elements leading to penalty.

- The PEA supports the use of existing infrastructure to support the Project operation, i.e., processing plant and TSF, power grid, magazines, drainage tunnel, workshops, roads, and auxilliary facilities.

Preparation of the PEA

The PEA was prepared independently by DRA Americas Peru (“DRA”), a subsidiary of DRA Global Limited (ASX: DRA | JSE: DRA), a diversified global engineering, project delivery, and operations management group. The PEA was prepared in accordance with the requirements of National Instrument 43-101 – Standards of Disclosure for Mineral Projects and has an effective date of January 31, 2023. A Technical Report relating to the PEA, prepared in accordance with NI 43-101, will be filled on www.sedar.com and posted on the Company’s website within 45 days of this news release.

Updated Mineral Resource Estimate

The updated MRE is supported by the available drilling database comprising 306 historic drillholes (17,797 m) and 41 drillholes (31,958 m) drilled by the previous owner between 2011 and 2021. The mineral resource statement of the Santander Pipe, with an effective date of June 30, 2022, is summarized in Table 2 below.

| Elevation Zone | Category | Tonnage (kt) | Zn (%) | Pb (%) | Ag (g/t) | Cu (%) | |

| Between 4020 m and 3885 m | Indicated | 1,656 | 7.5 | 0.03 | 15.6 | 0.11 | |

| Inferred | ---- | ---- | ---- | ---- | ---- | ||

| Below 3885 m | Indicated | 1,569 | 6.34 | 0.003 | 11.2 | 0.23 | |

| Inferred | 1,779 | 5.95 | 0.013 | 7.9 | 0.15 | ||

| Total | Indicated | 3,225 | 6.94 | 0.017 | 13.5 | 0.17 | |

| Inferred | 1,779 | 5.95 | 0.013 | 7.9 | 0.15 |

Notes:

- Mineral Resources are reported above a US$40 NSR cut-off.

- Metal prices used in the NSR calculations were US$3,000/t for Zn, US$2,200/t for Pb, US$9,300/t for Cu, and US$25/oz for Ag.

- NSR = (17.5 x %Zn) + (11.1 x %Pb) + (40.8 x %Cu) + (0.37 x g/t Ag), assuming recoveries of 90% for Zn, 70% for Pb, 60% for Cu and 50% for Ag.

- Two main mineralised zones are recognised at depth: (1) mineralized strata above 3,950 masl that has been largely mined down to level 4,020 masl, and (2) mineralization below 3,850 masl outlined by the deeper exploration drill holes.

- The declared Mineral Resources at Santander Pipe are below an elevation of 4,020 masl where the old mining operation did not reach production.

- The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource. While an Inferred Mineral Resource cannot be considered to be, or converted into a Mineral Reserve, it is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

- The Mineral Resources in this Technical Report were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions (2014) and Best Practices Guidelines (2019) prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

- The PEA MRE has been estimated by Mr. Graeme Lyall (QP).

- The MRE has an effective date of June 30, 2022.

- Resources are presented undiluted and in situ and are considered to have reasonable prospects for economic extraction. Isolated and discontinuous blocks above the stated cut-off grade are excluded from the mineral resource estimate. Must-take material, i.e., isolated blocks below cut-off grade located within a potentially mineable volume, was included in the mineral resource estimate.

- Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

The Mineral Resource model for the Santander Pipe has been updated following observations and recommendations made by DRA in January of 2022 as part of the previous NI 43-101 report on the Santander Property. The current resource model for Santander Pipe was initially developed by CDPR. This model was reviewed and revised with DRA to ensure that all aspects relating to the Mineral Resource Estimate comply with CIM reporting standards.

3D Geological interpretations of the mineralized domains were completed using Leapfrog GEO software. Metal grades were interpolated into blocks by ordinary kriging using Leapfrog’s EDGE block modelling module. The Mineral Resources were classified into Indicated or Inferred using CIM definition standards and guidelines. Levels with historic mining at Santander Pipe, above 4020 masl, are not included in the Mineral Resource.

Mineral Resources are reported above a Net Smelter Return (NSR) cut-off of US$40. The calculation of the NSR factors in metal prices, recoveries, as well as treatment and refining charges and deductions. The numbers used are based on recent production and processing of the Magistral mine products, and CDPR corporate guidance.

Geological Setting and Mineral Resource Potential

Santander Pipe and Related Mineralization

The first upside potential is the Pipe North zone, an extension of the Santander Pipe mineral corridor, discovered in June 2022. DRA reviewed the exploration and validated the discovery of the Pipe North zone as a new exploration target. CDPR has budgeted more drilling for 2023 to further explore and define the Santander Pipe North Extension, which is already established in a 900 m long mineralization corridor that includes the Santander Pipe.

“CDPR has already elected to access this area where drilling during 2022 has intersected a continuation of skarn mineralization to the north of the Santander Pipe. A tunnel is being mined southwards from the Magistral mine, and with a view to eventually linking this tunnel with the Santander Pipe mine once it has been dewatered. This tunnel will provide closer access for exploring this whole target area with much shorter drill holes.

DRA geologists have also noted that during the process of reviewing satellite and geophysical imagery of this general area, there is a circular geomorphological feature filled with scree material located close to the north of the “Pipe North” area. Given that the Santander Pipe is not the only pipe-like deposit to be found in this mining district, it is postulated that this scree material may be hiding a similar feature to the Santander Pipe underneath. If economic mineralization were to be confirmed beneath this location, mining from surface would be the easier option in terms of time and cost.” DRA Global—Santander Pipe PEA (2023, Section 25.2.3.2, page 153).

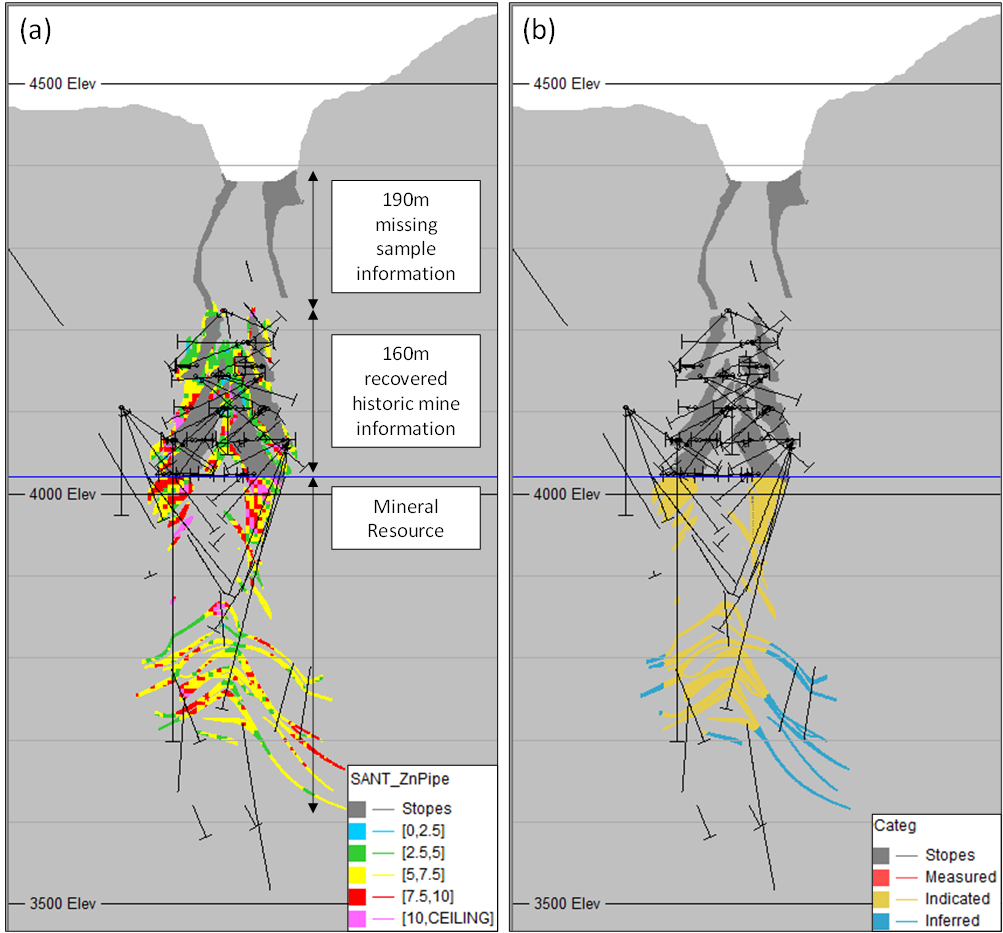

The second upside potential comprises unmined mineralization in the Upper Zone of the Santander Pipe, within the old mined out areas. The PEA Mineral Resource Estimation does not consider this area because it should be further characterized once CDPR gets access to the old Santander mine. Recent and historic estimates indicate a potential resource of between 3 and 4 Mt in these upper levels, averaging 4 to 6% Zn (see Figure 1). This unclassified potential resource was estimated by depleting the PEA mineral resource block model with the 3D envelopes of the historic mined areas. Further work will be carried out to confirm the 3D envelopes of historic mine voids, to determine the grade and tonnage of the remaining mineral resource, and to estimate the mineable portion of this mineral resource.

“Historic cut-off grades were higher than current considerations, resulting in those materials that, under current economic conditions, would be considered economic, were left unmined. Additionally, there were other non-technical issues that anticipated mine closure in the early 90’s, and that would have resulted in recoverable materials being left behind.

DRA considers that the recovery of potential economic mineralization in the historic mined areas represents an opportunity to improve initial mining cash flows and the overall project economics.” DRA Global—Santander Pipe PEA (2023, Section 14.8.2, page 125).

Figure 1. North-facing section showing potential for additional mineral resource in historic mined elevations: (a) estimated Zn content, (b) Mineral Resource Category

Geological Context

The Santander Property lies within the Central Peruvian Metallogenic Belt where the zinc mines and their associated Pb-Ag production have represented 12%, 7%, and around 10% of the world´s zinc, lead, and silver production, respectively, over the last two decades (USGS, 2001-2020). This tectonic segment of the Andean Cordillera hosts numerous world-class ore deposits, such as Antamina and Iscaycruz, in a 120 km wide and 800 km long belt.

The Santander Property comprises Cretaceous carbonate and clastic sedimentary rocks that were tightly folded into a series of northwest-trending anticlines and synclines, within a thrust-faulting structural context that, along with the occurrence of magmatic activity and intrusive rocks (Eocene – Miocene), favored the development of intrusion-related/carbonate-hosted polymetallic deposits. Amongst the local lithology, two groups stand out: the massive and marly limestones of Jumasha and Chulec Formations, hosting both the Magistral Deposit (active operation) and the Santander Pipe mineralization, and the massive limestones of the Santa Formation, hosting the Naty prospect, owned by CDPR.

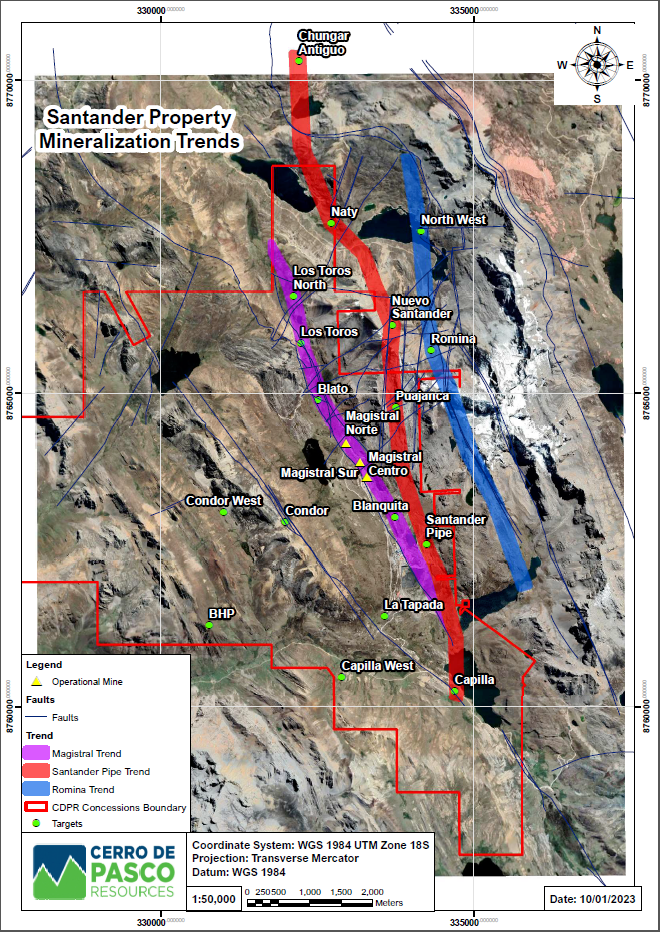

Three mineralization trends lie within the Santander Property and are the source of past and current mining operations and future resource potential (see Figure 2):

- Magistral trend: Goes parallel to the Santander Fault—the largest structural feature of the Property—and hosts the Magistral Deposits and prospects such as Blanquita, Blato, Los Toros, and Los Toros Norte. The Magistral Mine has been active since 2013 and has produced over 6.7 Mt @ 3 to 5% Zn, during 2013 – 2022.

- Santander Pipe trend: Goes along one of the main anticlines, located at the eastern portion of the Property, and hosts (i) the Santander Pipe and Pipe North Zn-Pb-Cu mineralization, (ii) the Puajanca prospect Pb-Ag mineralization lying 900 m SW of the Romina Project (owned by a third party), and (iii) the Natty prospect, located ~3 km North of the active Magistral Mine and containing a NW-SE strike portion of the Santa Formation. Historical drilling carried out by Votorantim, in 2011, found mineralization at 300 m depth within the Santa Formation, less than 900 m east of Naty. Furthermore, surface exploration, carried out by Trevali, obtained outcrop chip samples with some sporadic grades between 1.3 to 17.95% Zn grade in this area.

- Romina trend: Goes along folded rocks across the northeast part of the Property and hosts the Romina Project mineralization occurrences (Puagjanca, Esperanza, Adriana, and Andrea) and the Why Not prospect, owned by a third party.

Figure 2. Mineralization Trends in the geological context of the Santander Property

Underground Mine Development and Mine Access Trade-off

Subterra, an international engineering company, partnered with DRA to carry out the mine access trade-off study for the PEA. This study considered the four scenarios described below:

- Sole access through the existing Shaft

- 1.6 km long connection tunnel from Magistral to the Santander Pipe

- 600 m connection drive from the Pipe North zone to the Santander Pipe

- Combination of connection drive from the Pipe North zone to the Santander Pipe with the Shaft as hoisting system.

Scenario (4) is the preferred option to optimize costs and mining schedule and to provide operational flexibility—i.e., use the ongoing exploration tunnel to carry out the underground drilling in the Pipe North zone and the Santander Pipe, to mobilize equipment and personnel, and as auxilliary production route, and dewater and rehabilitate the existing Shaft to hoist mineral to surface.

Mining Method

The Santander Pipe is a 170 m diameter pipe-like mineralized body that extends down to 800 m depth as interpreted with the available drilling information. It comprises two broad zones:

- The Upper Zone, located above level 3,940 masl and shaped as a vertical pipe geometry with intermediate mineralized thickness (10 – 30 m) and steep mineralization plunge (> 55°).

- The Lower Zone, located below level 3,825 masl and shaped as manto-replacement mineralized zones that follow the anticline geometry of the local Formations, with narrow mineralized thickness (3 – 10 m) and shallow to intermediate mineralization plunge (20 – 55°).

The old Santander Mine operation used a form of sublevel stoping to mine the Upper Zone of the Santander Pipe, between 1969 and October 1992 (Buenaventura Ingenieros, 1993, pp. 47 - 50). The mining method comprised sublevels every 40 m and 2.5 x 3 m drawpoints every 10 m, with a production rate of 2,600 t per blast, 70% recovery, 25% dilution, and no backfill (Buenaventura Ingenieros, 1993, p. 49); mining such high stopes without backfill was possible due to the fair-to-good ground conditions in the Santander Pipe.

The PEA supports the use of the Avoca mining method with waste rock backfill and 20 and 15 m high sublevels in the Upper and Lower Zones, respectively. This is based on the geometry of the mineralization, geotechnical conditions, optimized stope recovery and dilution, and increased productivity up to 2,500 tpd production rate (see Table 3). The mineralization will be hoisted to surface through the Shaft; the connection drive will be used as auxiliary access to mobilize personnel and equipment and to haul the mineralization when required.

| Item | Total | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Production Tonnage (t) | 3,846,357 | 402,831 | 900,865 | 900,255 | 900,000 | 742,406 |

| Average production rate (tpd) | 2,137 | 1,119 | 2,502 | 2,501 | 2,500 | 2,062 |

| NSR (US$) | 89.26 | 101.61 | 89.44 | 90.26 | 87.46 | 83.30 |

| Zn (%) | 4.67 | 5.34 | 4.65 | 4.78 | 4.60 | 4.29 |

| Pb (%) | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.00 |

| Ag (g/t) | 8.05 | 10.25 | 9.41 | 7.93 | 6.70 | 7.00 |

| Cu (%) | 0.11 | 0.10 | 0.11 | 0.09 | 0.11 | 0.14 |

Recovery Methods (Mineral Processing)

The existing Santander concentrator facility comprises a three-stage crusher circuit, two parallel milling circuits, each with a rod and ball mill, flash lead flotation within the milling circuit; lead rougher, scavenger, and cleaner flotation; zinc rougher, scavenger, and cleaner flotation with a regrind mill, lead-concentrate thickening and filtration, zinc-concentrate thickening and filtration, final-tailings thickening, and a tailings-storage facility (TSF).

Recent mineral processing testwork by SGS indicate the possibility of upgrading the existing Santander Processing Plant to process both the Santander Pipe and Magistral Mine material. The upgrade of the Santander concentrator would involve the retrofit of the existing Pb circuit with a regrind ball mill and a horizontal vibrating screen which will allow this circuit to also produce either copper or lead concentrate.

Metallurgical test on samples from the Lower Zone indicate that the quality of the concentrate is similar to the one achieved historically with Santander Pipe mineralized material, i.e., Zn Concentrate over 48% Zn and Cu Concentrate over 20% Cu. It is possible to obtain saleable commercial grade concentrates as follows:

- Copper concentrate: 21% Cu at close to 70% recovery.

- Zinc concentrate: 51% Zn at 89% recovery.

Both copper and zinc concentrates will be subject to penalty conditions, should significant grades of arsenic, cadmium, lead, bismuth, manganese, antimony, and mercury be present within the concentrates. The ICP and AAS analysis on the concentrate products from the Locked Cycle Test, suggest that the concentrates are very clean and that there is no significant presence of deleterious elements leading to penalty.

Project Infrastructure

The Santander property is self-sufficient in terms of infrastructure required to support day-to-day production from the Magistral mine. The existing infrastructure was constructed during the pre-production period of 2011 – 2013, with the only external inputs being electrical reticulation, fuel, and processing reagents. The process plant was designed by Holland and Holland and commissioned by Trevali and Glencore Los Quenuales.

The PEA indicates the following with respect to infrastructure use for the Santander Pipe:- The existing processing plant to produce Zn and Cu concentrates from the Santander Pipe mineralized material. The metallurgical testwork indicates that the existing Pb circuit should be refitted with a regrind ball mill and a horizontal vibrating screen in order to produce Cu concentrate.

- The existing TSF with its full design and future growth stages has a 12-year storage life sufficient to store tailings from the Santander Pipe production.

- The existing power grid to integrate both the Magistral Mine with the Santander Pipe.

- The existing magazines for explosive and accessory storage to be used in the Santander Pipe.

- The existing drainage tunnel to discharge water out of the Santander Pipe.

Permitting Requirements

The ongoing mining operation at the Property is authorized by the 2012 EIA and the 2019 first EIA modification (MEIA 1), and their related Technical Supporting Reports (ITS in Spanish). The regulation framework also comprises associated permits for use of surface water and groundwater, water discharge, use and storage of explosives, quarry operations for borrow material, tailings reprocessing, mineral processing, and overall mining operation.

CDPR is carrying out the field work and the technical/engineering studies to be included in the second EIA modification (MEIA 2), which will support the deepening of the active Magistral Mine, the future Santander Pipe mining operation, the expansion of water treatment capacity, and the next TSF raise, amongst other elements. The corresponding starting requirements were filed before the environmental regulator, SENACE, in 2022. CDPR will complete the preparation and submittal of the MEIA 2 in August 2023; evaluation and approval are expected for 2024.

Capital Costs and Operating Costs Estimates

Initial Capital costs are estimated at $52.35M, considering that most of the Project infrastructure is in place. The main Initial Capital Costs are related to mine pre-production development and shaft dewatering and rehabilitation. Sustaining Capital Costs over the life-of-mine are estimated at $15.61M and are mainly related to sustained underground mine development and equipment and to increase the tailings storage capacity.

Initial Capital and Sustaining Capital Costs are summarized in Table 4.

Table 4. Summary of Capital Costs

| Item | Initial Capital Costs (MUSD) | Sustaining Capital Costs (MUSD) |

| Mine | 34.60 | 10.40 |

| Tailings Storage Facility | 0.00 | 2.92 |

| Process Plant | 0.60 | 0.00 |

| Site Infrastructure | 0.91 | 0.61 |

| Indirect Costs | 5.91 | 0.00 |

| Owner’s Costs | 1.81 | 0.00 |

| Contingency | 8.52 | 1.68 |

| Total | 52.35 | 15.61 |

Operating costs have been estimated from first principles, factoring from historical actual site costs, and estimates from DRA’s experience at other mines. Concentrate transport, smelting, refining, penalties and commodity prices are based on current and projected market conditions and consensus commodity pricing. Operating costs and unit operating costs have been summarized in Table 5 and Table 6.

| Cost Area | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Total kUS$ |

| Mine | 18,183 | 22,254 | 20,445 | 21,088 | 16,532 | 98,503 |

| Plant | 7,139 | 10,474 | 10,474 | 10,474 | 7,061 | 45,623 |

| G&A | 5,948 | 8,727 | 8,727 | 8,727 | 5,883 | 38,012 |

| Total Cost | 31,270 | 41,455 | 39,647 | 40,289 | 29,476 | 182,138 |

| Unit Cost Area | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | US$/t |

| Mine | 33.68 | 24.73 | 22.72 | 23.43 | 27.25 | 25.61 |

| Plant | 13.22 | 11.64 | 11.64 | 11.64 | 11.64 | 11.86 |

| G&A | 11.02 | 9.70 | 9.70 | 9.70 | 9.70 | 9.88 |

| Total Unit Cost | 57.93 | 46.06 | 44.05 | 44.77 | 48.58 | 47.35 |

Economic Analysis

The economic analysis was carried out using a discounted cash flow model with 6% discount rate. The discount rate is based on the Project being part of an ongoing mining operation and a historically mined area, as opposed to a new operation. The economic analysis is summarized in Table 7.

| Cash Flow (Life of Mine) | MUSD |

| Revenue from Concentrate | 388.6 |

| (-) Operating Cost | 182.1 |

| (-) Capital and Sustaining Capital Cost | 68.0 |

| (-) Sales Expenses | 26.2 |

| (-) Workers Participation | 12.7 |

| Pre-Tax Cash Flow (undiscounted) | 99.6 |

| Pre-Tax NPV (6% discount rate) | 71.3 |

| Pre-Tax IRR (%) | 46.6 |

| (-) Taxes | 49.8 |

| After-Tax Cash Flow (undiscounted) | 49.8 |

| After-Tax NPV (6% discount rate) | 31.2 |

| After-Tax IRR (%) | 25.1 |

| After-Tax Payback (Years) | 2.6 |

Sensitivity Analysis

DRA prepared a sensitivity analysis reflecting different commodity prices and discount rates (from 5% to 15%) that could have a significant effect on the financial performance of the Project. Using different discount rates has a minor impact on NPV. Table 8 below presents a sensitivity of economic parameters to a ±20% change in long-term zinc price. It is highlighted that the current spot price of zinc is approximately 111% of the base case assumption.

Table 8. Project Economics Sensitivity to Zinc Price (Base Case Highlighted in Bold)

| % of Zn Price | 80% | 85% | 90% | 100% | 110% | 115% | 120% | |

| US$/t Zn | 2,240 | 2,380 | 2,520 | 2,800 | 3,080 | 3,220 | 3,360 | |

| Pre-Tax | NPV 6% (MUSD) | 9.9 | 25.3 | 40.6 | 71.3 | 102.1 | 117.5 | 132.9 |

| NPV 8% (MUSD) | 6.5 | 20.8 | 35.1 | 63.7 | 92.4 | 106.7 | 121.1 | |

| IRR (%) | 12.6 | 22.0 | 30.7 | 46.6 | 61.2 | 68.2 | 75.0 | |

| After-Tax | NPV6% (MUSD) | -10.4 | 0.1 | 10.5 | 31.2 | 51.7 | 61.6 | 71.7 |

| NPV 8% (MUSD) | -12.5 | -2.7 | 7.0 | 26.3 | 45.4 | 54.7 | 64.0 | |

| IRR (%) | -1.4 | 6.1 | 12.9 | 25.1 | 36.2 | 41.3 | 46.2 |

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by:

- Mr. Graeme Lyall (FAusIMM), an independent consulting geologist with over 30 years of professional experience in precious and base metals exploration, geological modelling and mineral resource estimation for the purposes of reporting in compliance with NI 43-101.

- Mr. Martin Mount (FGS CGeol, FIMMM CEng), an independent consultant and geoscientist, is a professional geoscientist and engineer in the fields of geology, Mineral resource and Mineral Reserve estimation and classification, geotechnical engineering, geometallurgy, and mine planning. Mr. Mount is a Qualified Person for the purposes of reporting in compliance with NI 43-101.

- Mr. David Frost (FAusIMM), DRA Americas VP Process Engineering, consulting metallurgical engineer with more than 27 years of technical and management experience in plant operations, process plant design, commissioning, due diligence review, laboratory supervision and consulting. Mr. Frost is a Qualified Person for the purposes of reporting in compliance with NI 43-101.

- Mr. Javier Aymachoque Tincusi (MAusIMM CP (Min)), consulting mine engineer and project infrastructure specialist, is a professional engineer in the fields of mine engineering, mine operations, site wide mine and infrastructure design, environmental permitting, capital and operating cost estimation, and mineral economics. Mr. Aymachoque is a Qualified Person for the purposes of reporting in compliance with NI 43-101.

Jorge Lozano, MMSAQP and Chief Operating Officer for CDPR, has reviewed and approved the scientific and technical information contained in this news release. Mr. Lozano is a Qualified Person for the purposes of reporting in compliance with NI 43-101.

Note on Assumptions

The PEA results are based on important assumptions made by the Qualified Persons who prepared the PEA. These assumptions, including those mentioned above, and the justifications for them, will be described in the PEA Technical Report that the Company will file on SEDAR and post on the Company's website within 45 days of this news release.

The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized.

About Cerro de Pasco Resources

Cerro de Pasco Resources Inc. is a mining and resource management company with unparalleled knowledge of the mineral endowment in the city of Cerro de Pasco and its surroundings. Initially, the Company will unlock the useful life of the mine and extend the concession areas in its Santander mining operation, applying the highest safety, environmental, social and governance standards. The key focus of the growth for the Company is on the development of the El Metalurgista mining concession, one of the world's largest surface mineralized resources, applying the latest techniques and innovative solutions to process tailings, extract metals and convert the remaining waste into green hydrogen and derivatives.

About DRA Americas Peru

DRA Americas Peru is a subsidiary of DRA Global Limited and is responsible for the NI 43-101 Technical Report entitled "Cerro de Pasco Resources - NI 43-101 and Resource Estimate Updates for Santander Mine Magistral and Pipe, Peru" is dated January 24, 2022. DRA Global Limited (ASX: DRA | JSE: DRA) is a diversified global engineering, project delivery and operations management group, headquartered in Perth, Australia. It has more than 4,500 professionals and a proven track record in undertaking independent assessments of Mineral Resources and Mineral Reserves, project evaluations and audits, technical reports and independent evaluations on behalf of exploration and mining companies, and financial institutions worldwide.

Forward-Looking Statements and Disclaimer

Certain information contained herein may constitute “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified using forward-looking terminology such as “plans”, “seeks”, “expects”, “estimates”, “intends”, “anticipates”, “believes”, “could”, “might”, “likely” or variations of such words, or statements that certain actions, events or results “may”, “will”, “could”, “would”, “might”, “will be taken”, “occur”, “be achieved” or other similar expressions.

Forward-looking statements, including the expectations of CDPR’s management regarding the completion of the project as well as the business and the expansion and growth of CDPR’s operations, are based on CDPR’s estimates and are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of CDPR to be materially different from those expressed or implied by such forward-looking statements or forward-looking information.

Forward-looking statements are subject to business and economic factors and uncertainties and other factors, such as Covid-19, that could cause actual results to differ materially from these forward-looking statements, including the relevant assumptions and risks factors set out in CDPR’s public documents, available on SEDAR at www.sedar.com. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Although CDPR believes that the assumptions and factors used in preparing the forward-looking statements are reasonable, undue reliance should not be placed on these statements and forward-looking information. Except where required by applicable law, CDPR disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Further Information

Guy Goulet, CEO

Telephone: +1-579-476-7000

Mobile: +1-514-294-7000